Professional Tips on Getting Authorized for a Secured Credit Card Singapore

Professional Tips on Getting Authorized for a Secured Credit Card Singapore

Blog Article

Introducing the Possibility: Can Individuals Discharged From Insolvency Acquire Credit Report Cards?

Comprehending the Effect of Bankruptcy

Upon declare insolvency, individuals are faced with the considerable effects that permeate different facets of their monetary lives. Insolvency can have a profound effect on one's credit history, making it challenging to access credit report or lendings in the future. This financial tarnish can linger on credit report reports for several years, affecting the person's capacity to protect positive rates of interest or financial opportunities. In addition, personal bankruptcy might lead to the loss of assets, as certain ownerships may require to be sold off to settle financial institutions. The emotional toll of insolvency ought to not be ignored, as people might experience feelings of guilt, pity, and anxiety due to their financial scenario.

Moreover, personal bankruptcy can limit work opportunities, as some employers perform credit score checks as component of the hiring procedure. This can position a barrier to individuals looking for new work leads or job advancements. Overall, the impact of personal bankruptcy prolongs beyond economic restrictions, influencing numerous aspects of an individual's life.

Variables Influencing Bank Card Approval

Getting a charge card post-bankruptcy rests upon various key elements that substantially affect the approval process. One important variable is the applicant's debt rating. Adhering to insolvency, people frequently have a low credit history due to the negative impact of the bankruptcy declaring. Credit score card firms normally search for a credit report that shows the applicant's ability to manage credit history properly. Another vital factor to consider is the applicant's earnings. A steady revenue comforts charge card companies of the individual's capability to make timely settlements. Furthermore, the size of time given that the insolvency discharge plays a vital duty. The longer the duration post-discharge, the a lot more desirable the opportunities of authorization, as it shows economic stability and liable credit scores actions post-bankruptcy. Additionally, the sort of charge card being used for and the issuer's details requirements can likewise affect authorization. By meticulously thinking about these aspects and taking steps to restore credit scores post-bankruptcy, individuals can enhance their leads of getting a charge card and functioning towards economic recuperation.

Actions to Rebuild Credit History After Insolvency

Reconstructing credit score after personal bankruptcy calls for a tactical method concentrated on monetary self-control and regular financial debt management. The initial step is to examine your credit scores report to guarantee all financial obligations included in the personal bankruptcy are precisely mirrored. It is necessary to develop a budget plan that focuses on debt payment and living within your ways. One efficient strategy is to acquire a guaranteed bank card, where you deposit a certain amount as collateral to develop a credit report restriction. Timely settlements on this card can demonstrate accountable credit scores usage to potential lenders. Furthermore, take into consideration coming to be an authorized customer on a relative's charge card or discovering credit-builder fundings to additional boost your credit report. It is vital to make all payments promptly, as repayment background considerably impacts your credit rating. Persistence and determination are crucial as reconstructing credit score requires time, but with dedication to appear economic methods, it is possible to boost your creditworthiness post-bankruptcy.

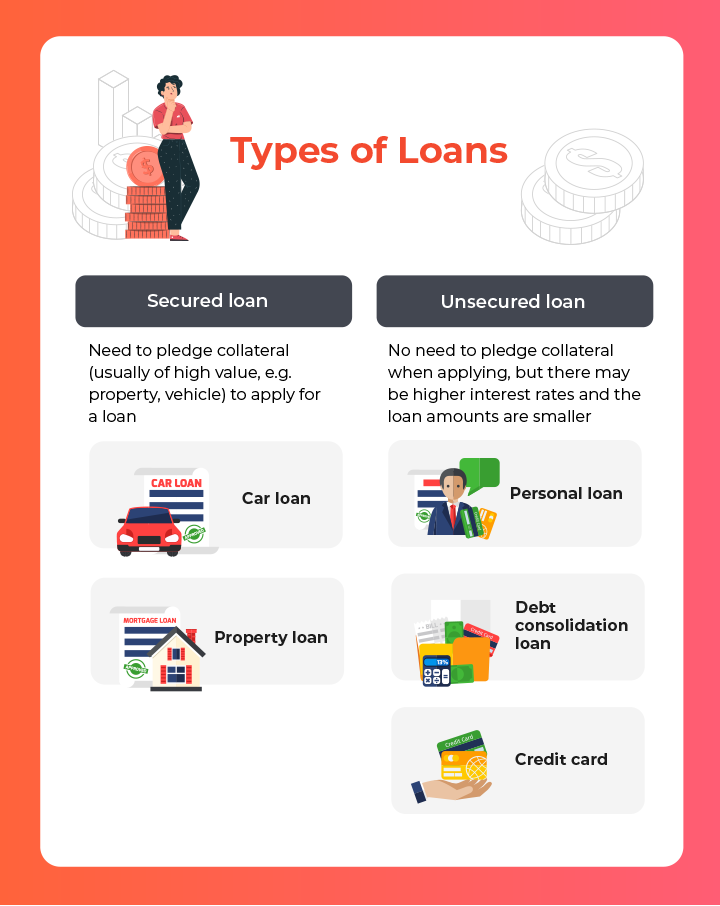

Safe Vs. Unsecured Credit Scores Cards

Following bankruptcy, individuals usually consider the selection between secured and unprotected credit scores cards as they intend to rebuild their creditworthiness and economic security. Safe credit history cards need a cash money down payment that serves as collateral, usually equivalent to the credit scores limitation approved. Ultimately, the selection in between secured and unsafe credit scores cards should straighten with the person's monetary purposes and capability to handle credit rating sensibly.

Resources for People Seeking Debt Restoring

One here beneficial resource for people looking for credit scores rebuilding is credit report counseling companies. By working with a credit scores therapist, people can obtain understandings right into their debt reports, discover approaches to enhance their credit history ratings, and receive guidance on managing their financial resources properly.

Another practical source is debt surveillance services. These services permit individuals to maintain a close eye on their credit score records, track any type of modifications or errors, and find potential indications of identification burglary. By monitoring their credit rating regularly, people can proactively deal with any kind of problems that might emerge and guarantee that their credit history details depends on date and accurate.

Moreover, online tools and resources such as credit score simulators, budgeting applications, and monetary proficiency internet sites can offer individuals with important details and tools to aid them in their credit reconstructing journey. secured credit card singapore. By leveraging these resources successfully, people released from insolvency can take purposeful steps in the direction of improving their credit history wellness and protecting a far better monetary future

Verdict

In final thought, people released from insolvency go may have the possibility to obtain debt cards by taking actions to restore their credit. Variables such as credit rating debt-to-income, background, and income proportion play a considerable duty in charge card authorization. By understanding the impact of insolvency, picking in between protected and unprotected charge card, and utilizing resources for credit scores restoring, people can enhance their credit reliability and potentially get accessibility to charge card.

By functioning with a debt counselor, individuals can gain insights into their credit scores records, learn methods to increase their debt scores, and get support on managing their finances effectively. - secured credit card singapore

Report this page